So, I just received a Gmail notification which I tapped to confirm the message, and smiled; “good client, he’s not owing today” I mumbled with a toast of Bacchus wine in my left hand. At the moment, I notice this sharp guy at my back picking over my shoulder. And seriously, I needed to move the Dollars from my PayPal account to a local bank.

Then there was a relieve by the time my PayPal prompted an option to login with my fingerprint instead of the usual password.

Chei, see pain, my sharp guy was left devastated. For me, it was speedy access to cash transfer but to my guy, no joy.

Like, how would you memorize fingerprints?

Although I couldn’t tell if he was prying to get access to my phone for music or games or for whatever, but all I knew was that the fingerprint authentication came through for me that day.

Aside from the ease of usage and speedy transactions, safety is one of the many reasons for biometrics in banking.

Do you find it difficult entering your password on your device or mobile for the fear of someone looking? Biometric authentication is what you need.

Keep reading, there are pretty interesting facts and gist that’ll solidify why I said so.

In this article, you’ll discover major reasons why banks use biometrics so you can take advantage of it and won’t fall victim to fraud. But then, I’d like to water the ground, by telling you the meaning of biometrics, a type of biometrics in banking. Finally, we’ll conclude with biometric payments.

What is Biometrics?

Biometrics is a combination of two Greek words “bios” as in Biology which means “life’ ‘ and “metron’ ‘ which translates to measure. The combination of both words translates to “life measure”.

We can comfortably say that Biometrics is the measurements of life through analyzing characteristics and behaviors traits that are unique in humans for identification.

As you just read, the fingerprint sensor at the back of my phone was able to identify that I wasn’t the user at the moment and access was denied. You should know that the benefits of biometric authentication are more than finance( that’s a topic for another blog, let’s talk about moNEY today).

How We Got to Biometrics in Banking?

Before smartphones, people have always found ways to keep their belongings safe. Before the internet, locks and keys were the best method to keep properties safe, by then, secret passwords were also popular to a few people.

When banking began operation, the safest security was the vault, a safe method that uses a complex lock system to gain access you’ll have to confirm your identity by signing on a paper, and then, an officer will confirm if you were the owner. If you ask me, I’ll say it was an effective method of identity verification, but considering the rate of stolen keys and forged identities, I would rather bury my money.

Fast forward to the time when we saw some improvements in technology which brought about personal identification numbers (PINs), and passwords. What a relief, people were able to access their money with four digits or letters. This was safer and easier than the vault and keys era (I wasn’t there).

However, a common problem was people often forgetting their four digits (I forgot mine countless times), but the scariest part was how some people could easily memorize another person’s PIN codes and gain unauthorized access to their money. The rate of identity theft and money fraud was alarming, what a way to close an era.

Welcome to the 21st Century, Genz in particular:

In this era of smartphones and mobile banking, identity authentication has turned personal so that you can only gain access to your account through your fingerprint, the shape of your face, your voice, or the pattern of your iris. Although identity theft and online fraud are very much around, but then, biometrics authentication has made it unnoticed.

The Time Before Biometrics

Measuring human features for identification didn’t begin with smartphones as many are thinking.

History tells us in 500 BC, ancient Babylonians used clay tablets with their fingerprints to record business transactions.

The practice where employers would read a handprint to identify an employee was seen in the 19th century.

A French police officer used actual body measurements to identify criminals. Sir Francis Galton achieved a modernized and detailed fingerprint ID system.

Francis Bruh first discovered the possibility of the Iris recognition. In 1952, Bell Labs designed a successful voice recognition machine. Now, biometrics in banking has become a major means of Identity authentication.

How Biometrics Work

My story at UBA, the branch before Access Bank inside the Rivers State University(RSU) campus, wasn’t as funny as it would sound. After stating my complaints to this good and well-mannered lady, she consented to help me.

She pointed to a door saying “Give this form to the marketing manager” Long story short, I had stood there for no less than 15 minutes fumbling to get past that door.

My face blushed in frustration but brightened again when an officer rushed down and apologized for leaving his duty post. All it took from him was a thump against the sensor and I was in. Now, that’s how biometrics works, instead of locks and keys, it recognizes body parts as the access tool.

The door seems to recognize that officer because the biometric information on the database matches with his and won’t open up for me. The explanation for this is that everyone is unique.

Types of Biometrics in Banking

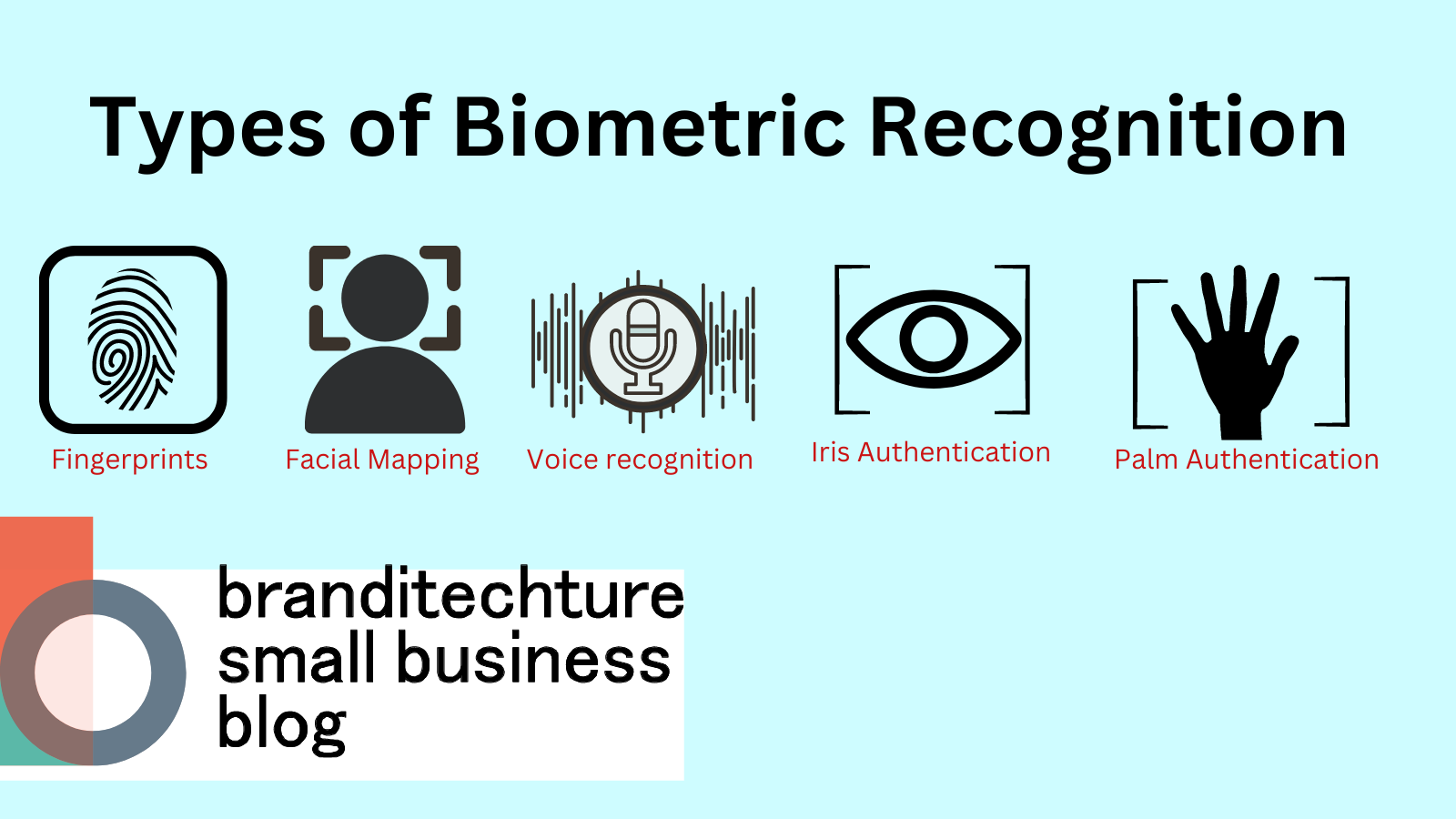

Here are some of the major biometrics authentication introduced by fintech companies into financial institutions, banks, and businesses:

Fingerprint Scans:

Fingerprint scanners collect the unique patterns of ridges and valleys on a person’s finger to identify or verify their identity. You now know why that mr sharp guy couldn’t gain access to my smartphone and why I couldn’t get past that door at the bank, our fingerprints are unique.

Facial Mapping:

Facial Recognition technology measures the size and face structure by analyzing the distance between your eyes, the shape of your nose, and facial features in general.

Voice Recognition

Voice biometrics is like fingerprint biometrics but this time in audible format. It recognizes what makes your voice unique from Peter’s which are pitch volume, rhythm, and tone.

Signature recognition:

You may think this is your usual way of signing in where you just do gibberish on paper and expect a timid attendant to say “correct” This one is on a device that looks at how you sign your name and weighs your signing pressure, speed, and stroke patterns. So, when doing your thing, be guided otherwise, you’re on your own(OYO).

Added to these major biometrics, there are also Iris scans, palm authentication, gait recognition and more.

What Makes Biometrics So Useful?

Biometric banking has brought speed to financial transactions, in less than 10 seconds, you’ve made your withdrawals or transfers.

These days you don’t have to worry about who is prying on your PIN codes, just thumb-hug your smartphone sensor and your mobile bank app is up.

And on many occasions, biometric authentication has managed to prevent afternoon madness, like in my experience at my friend’s party.

Imagine if I had used only a 4-digit password, the dude would have gained access to my device, but pain would reach him at my PayPal, that one uses fingerprints, lol.

If you were following, you would notice that biometrics authentication is useful because it brings about speed in transactions, authenticated access, and tight security. This is to curb identity theft and all the crime that’s associated with cyber fraud because, for example, fingerprints are difficult to forge or steal so are other biometrics.

What is a Biometric Payment?

Biometric payment is a transaction, (either receiving or sending) that uses your physical characteristics and behaviors to identify you as the owner before completing the payment. I wouldn’t like to repeat myself on the type of biometrics authentication again.

Just know that biometric authentication is the safest and fastest method of doing transactions because you can’t forge or steal someone’s biometrics and there’s nothing like: “I forgot my fingerprints biometrics”. So, you’re just safe with it.

Some of the ways people make biometric payments are:

1. Retail transactions:

Customers use biometric identifiers like fingerprints to get through with their payments at big supermarkets. Some advanced Point of sale stands(POS) in Nigeria, require your fingerprint authorization before making payments.

2. Financial Entities:

Banks and financial institutions have depended on biometric authentication for smoother operations such as the transfer of funds, customer registration, and account monitoring. Currently, Nigerian banks have bought the idea of fingerprint technology to authenticate transactions on their mobile app.

3. Digital wallets: Digital wallet owner uses biometric authentication to access their digital tickets, make payments, or perform other services. This is most needed for the security of users, fast wallet access ment, and positive User experience.

Why You Should Entrust Your Money to Banks with Biometrics

Collecting and storing bio-data is a serious privacy concern that requires financial institutions, banks, and businesses to comply with data protection regulations such as the Nigeria Data Protection Regulation(NDPR). Failure to legally biometric data can lead to severe penalties on them. And failure of these bodies not to use the biometrics system shows they are dealing against the law and are not to be trusted.

The reason is that biometric authentication is a legal requirement for regulatory compliance and serves as a defense against fraud.

According to the Javelin 2022 ID Fraud Study, about 22% of U.S. adults, that’s roughly 24 million households, have encountered account takeover (ATO) incidents. If this could happen in a more technically advanced country, how much our Naija?

To mitigate such reoccurrence, banks combine biometric verification with other authorization measures, like a PIN or a password, resulting in a multi-factor authentication (MFA) system.

The MFA method takes things a step further by requesting something the user knows (like a password) and something the user has (their biometric trait). So, you should take advantage of this development and save yourself some hurtful stories.

Conclusion

I imagine yourself pouring water in a basket, that’s unthinkable, to begin with. When it comes to monetary transactions, trust, safety, and speed are important.

The truth is that people will always put in their money where they’re assured of 100% safety and 24/7 personalized access to it.

These technologies are available but some people don’t like technology. Dear, save yourself from the madness in broad daylight(avoid money theft). Go and activate that fingerprint on your bank, and use that face recognition in your wallet.

Experiencing biometrics in banking is better off asking.